[sc name=”ad-250×250″][/sc]

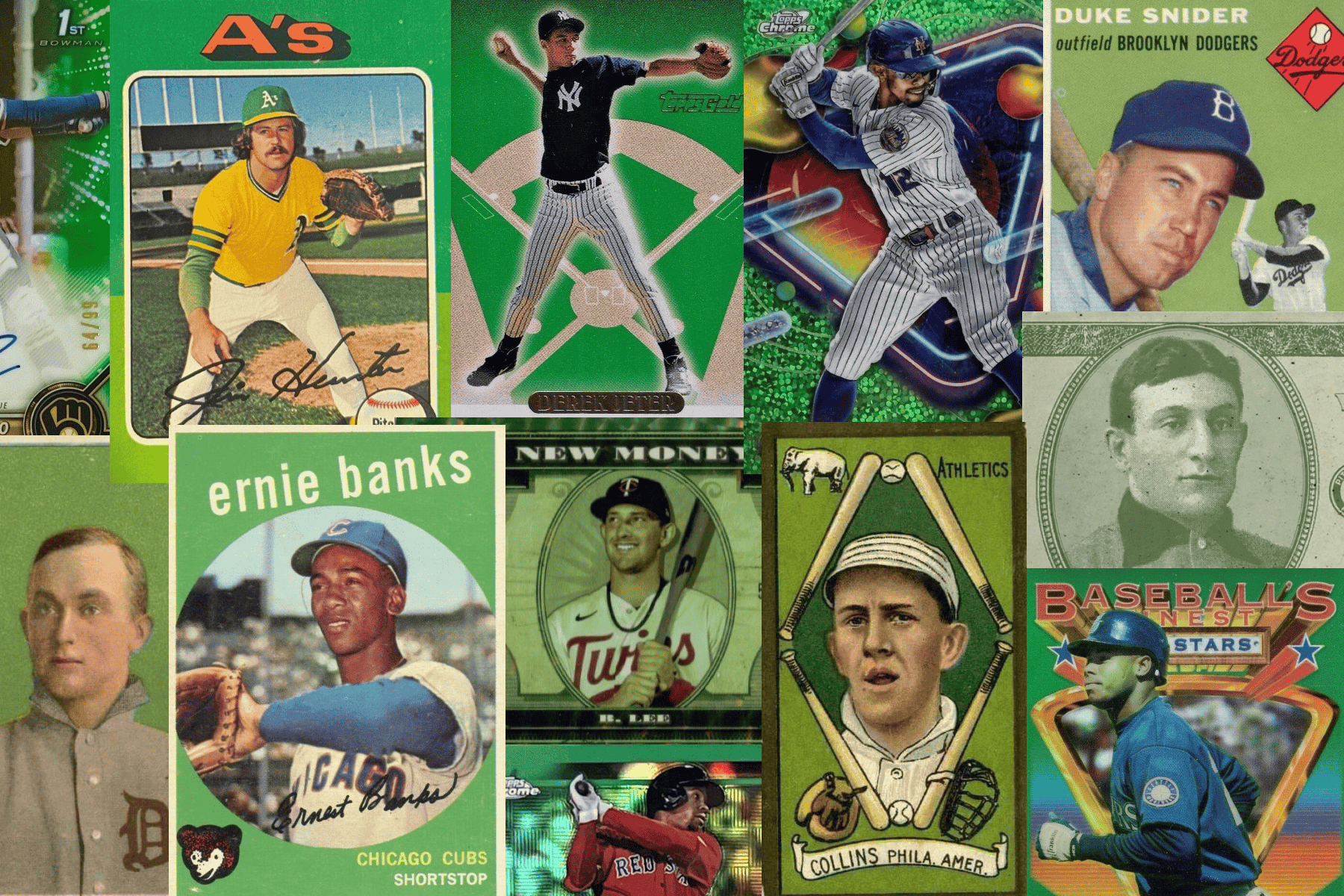

The allure of baseball cards transcends childhood nostalgia. They represent a tangible connection to baseball legends, a potential store of value and, for some, a lucrative investment opportunity. But within the baseball card investing plan lies a crucial decision: flip or hold?

This guide dives into the strategies for both short-term flipping and long-term baseball card investing, equipping you to navigate the dynamic world of making money with your baseball card collection.

Flipping: Short-term Baseball Card Investing

Flipping, the act of buying and selling cards quickly to generate a profit, thrives on market volatility. While it can be a thrilling way to turn a fast buck, it requires a keen understanding of market trends, player performance, and hype cycles.

Flipping Strategy

Market Pulse

Stay glued to the hobby. Follow industry publications, social media groups, and auction results. Identify rising stars, hot rookies, and vintage sets experiencing renewed interest.

Here’s a thought exercise on market pulses: When was the best time to buy a Mark McGwire rookie card? Think about your answer – many people bought McGwire’s 1987 cards when he was a young player, which is a valid reaction. However, his cards were at their peak value in 2000, during the homerun chase between McGwire and Sosa. Finding the sweet spot between buying low, in anticipation of selling high, is the key to succeeding in reading the pulse.

Undervalued Gems

Seek out underpriced cards with the potential for a quick rise. Look for overlooked rookies, breakout seasons, or undervalued Hall of Famers. Utilize auction listings with ending soon notices or poorly photographed cards that might be missed by others.

One quick tip: Find the low-cost dip between when a popular player retires and when he’s likely to be elected to the National Baseball Hall of Fame, typically five years later. For example, in early 2024, now is the time to snatch up cards of Ichiro, C.C. Sabathia, and other players likely to be elected in 2025 or 2026.

Grading Considerations

While grading can significantly increase a card’s value, consider the upfront cost. For short-term flips, focus on raw cards with high-eye appeal (obvious mint condition) to maximize potential profit margins.

Remember that grading also takes time. If you’re trying to ride a short-term wave, timing a submission to one of he big grading companies can be very difficult unless you attend an in-person event or you’re willing to pay for rush processing.

Quick Listings

Price your cards competitively and slightly above market value to attract immediate interest. Utilize online marketplaces with high traffic and emphasize the card’s key selling points in the listing description. Consider offering free shipping to incentivize buyers.

Be Patient (Sometimes)

Don’t undercut yourself just to make a quick sale. If a card has strong fundamentals, waiting for the right buyer can yield a higher return.

A short-term fail can still turn into a long-term success. Players who flounder in their rookie year, or who aren’t elected to the Hall of Fame when you expect it, can still be held on the chance that they’ll turn things around. Players like Hoyt Wilhelm, Randy Johnson and Jose Bautista all found success after age 29.

Short-Term Investing Considerations

Market Saturation

Beware of over-saturation, especially with recent rookies. The market might be flooded with the same card, making it difficult to flip for a profit. You not only need to buy when the timing is right, but consider what you’re buying and making sure there is rarity.

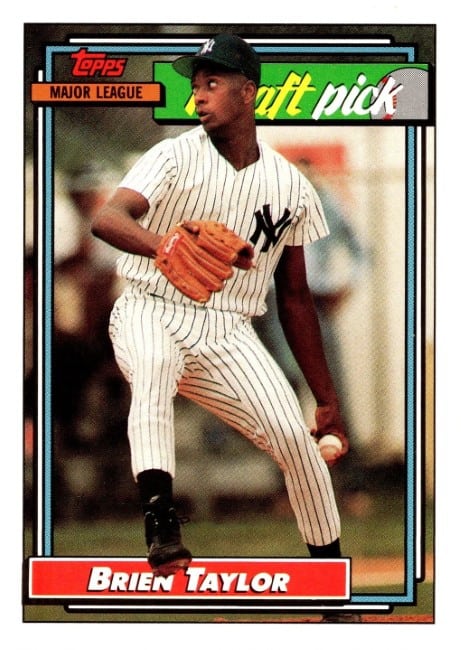

Hype vs. Reality

Understand the difference between genuine talent and short-term hype. A hot prospect’s performance can quickly fizzle, leaving you holding a depreciating asset. Although the MLB Draft is a great source of speculating and making money, you can also get burned by players who never see a Major League field. (Examples include Brady Aiken, Brien Taylor, Matt Hobgood and Donavan Tate.)

Holding: Long-Term Baseball Card Investing

Long-term investing in baseball cards focuses on acquiring and holding cards with the potential for significant value appreciation over a period of years, even decades. This strategy demands a focus on established stars, legendary names, and historically significant sets.

Strategies for the Long-Term Investor:

Legendary Players

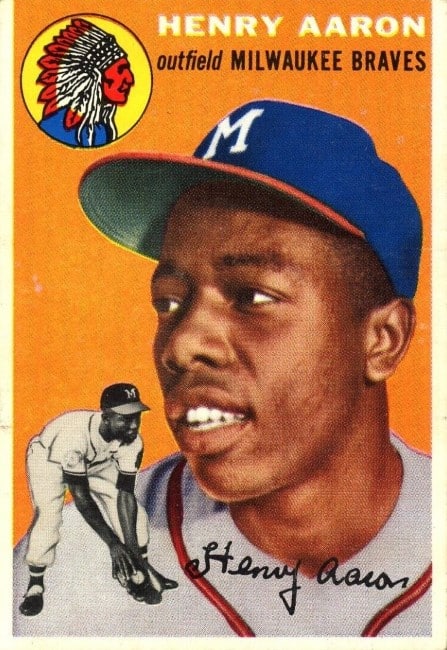

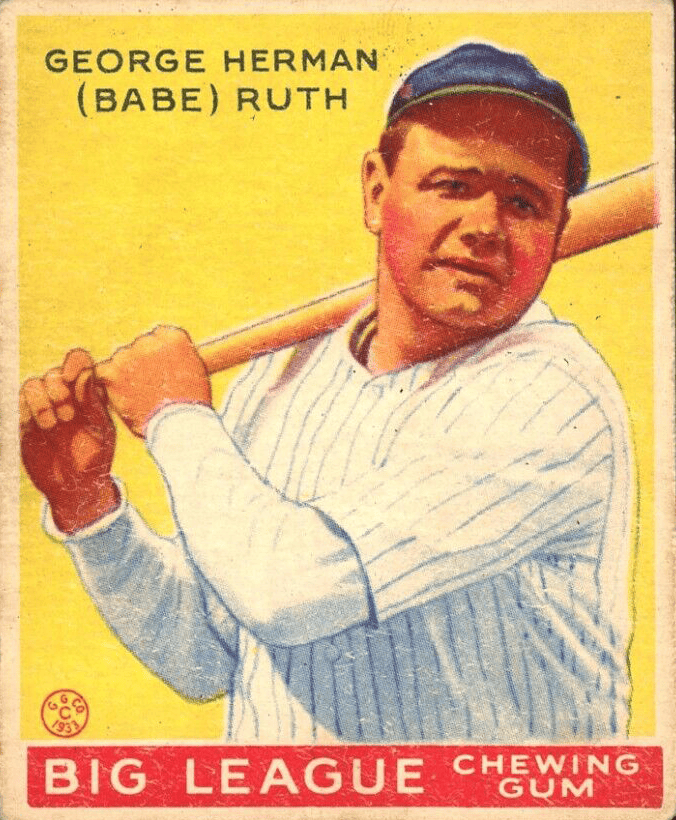

Prioritize cards of iconic players with proven track records, championship pedigree, and enshrinement in the Hall of Fame. These cards tend to maintain a strong baseline value and appreciate over time.

Demand for baseball legends like Mickey Mantle and Babe Ruth will never fade. Take the time to pick up good value cards and hold them. They make great “forever” investments, or capitalize on interest caused by high-profile finds and sales to put your own on the auction block.

Vintage Sets

Invest in complete sets or key cards from coveted vintage sets like the T206s, 1952 Topps, or early Bowman releases. These sets have limited supply and a dedicated collector base, driving long-term value. There will always be plenty of collectors trying to complete these sets, which puts even common cards in a premium price point.

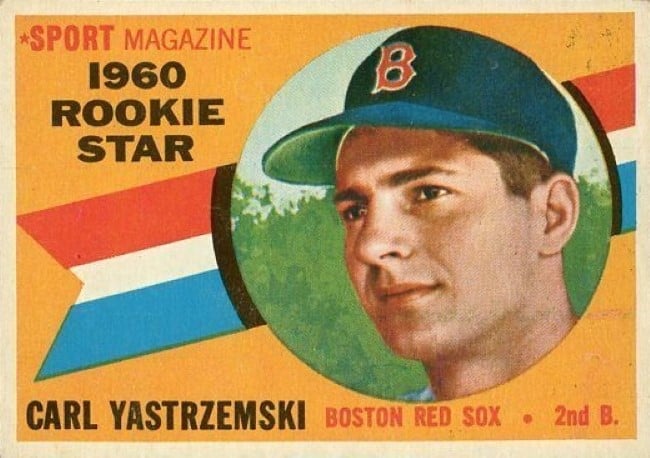

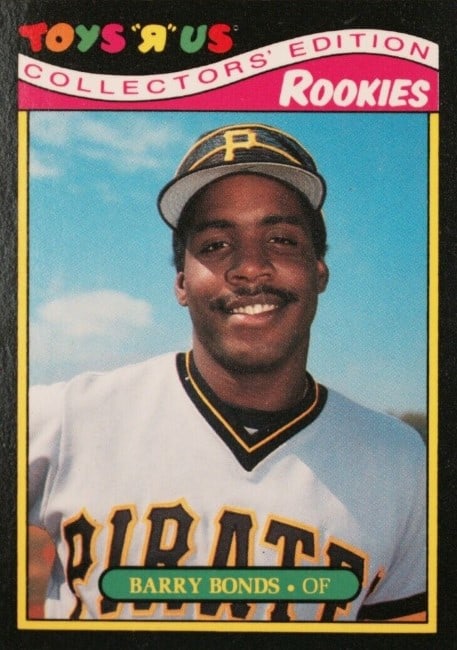

Rookie Cards

Focus on high-graded rookie cards of future Hall of Famers or historically significant players. Look for PSA 10 (gem mint) or BGS 9 (pristine) grades for maximum long-term value.

This is where you need to decide how you’ll evaluate talent – there tends to be a bubble around cards of high prospects, and you don’t want to buy at that time. It can make more economic sense to track careers and purchase players who are quietly performing well over a number of professional seasons. Recent examples include Adrian Beltre, or players whose Hall of Fame stock has been increasing.

Long-Term Investment Considerations

Market Fluctuations

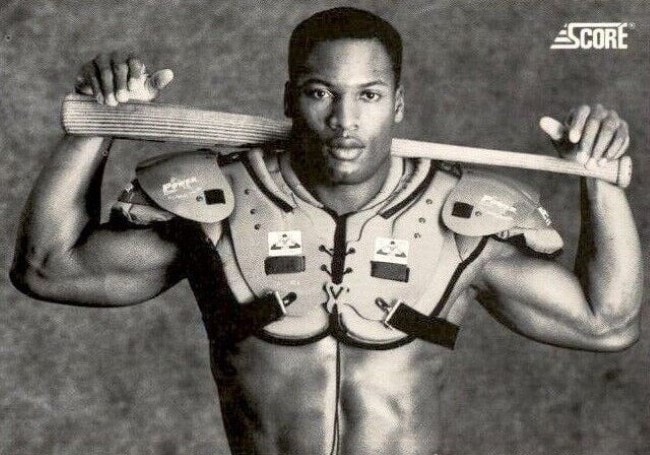

The market for baseball cards experiences periodic downturns. Long-term investors should have the patience to weather these storms, confident that the underlying value of their portfolio will eventually rise. Events like work stoppages, injuries, suspensions and also general economic depressions can bring down the price of cards. Most will recover, but there are examples – like Bo Jackson and Albert Belle’s career-ending injuries – for which their card values will never reach the potential they were once thought to have.

Liquidity

While valuable cards can be readily sold through auctions or reputable dealers, understand that selling a long-term holding might require more time and effort compared to flipping. This means the money isn’t available to spend on something else (either a different card, or something else in your life like a car payment).

Flip or Hold? Baseball Card Investing Strategies

The choice between flipping and holding depends on your financial goals and risk tolerance. Here are some pointers to guide you:

Short-Term Goals: If you need to generate quick cash or enjoy the thrill of the chase, flipping might be a better option.

Risk Tolerance: Flipping carries a higher degree of risk as market trends can shift rapidly. Long-term investing offers a more stable approach, with appreciation potential outweighing short-term volatility.

Available Capital: Flipping often necessitates a smaller initial investment, allowing you to test the waters. Long-term investing typically requires a larger capital outlay for high-value cards.

Collecting vs. Investing: While the lines can blur, collectors prioritize the personal enjoyment of owning a card, while investors focus solely on its financial potential. Flipping caters more to the investor mindset, requiring an objective detachment from the emotional attachment collectors might have.

Building a Successful Investment Portfolio

Diversification: Don’t put all your eggs in one basket. Diversify your portfolio across different eras, players, and card types to mitigate risk. Failing to diversify means that one negative event can bring down your portfolio – sometimes for good.

Do Your Research: Before buying any card, research its historical value, current market trends, and future outlook. Utilize reputable price guides and track recent auction sales for similar cards. There is no substitute for cold, hard data and research.

Understand the Odds: Plenty of people make their living buying and selling baseball cards. It’s an achievable goal. However, keep in mind that the extreme outliers – those $12.6M Mickey Mantle cards – are rare for a reason. Focus your collection on making smart financial decisions instead of moonshots.

Authentication is Crucial: For high-value cards, especially vintage or autographed ones, obtain authentication from a reputable grading company like PSA or BGS. This ensures the card’s legitimacy and protects your investment. Graded cards also typically sell for much higher prices than ungraded cards.

Condition is King: Regardless of strategy, prioritize cards in pristine condition. A PSA 10 or BGS 9 card will almost always outperform its lower-graded counterparts. However, if you have a limited amount of money and can’t afford the perfect card, find those that are still coveted in poorer conditions.

Conclusion

The world of baseball card investing offers exciting opportunities for both short-term and long-term gains. By understanding the nuances of flipping and holding, and by implementing the strategies outlined above, you can develop a successful investment plan that aligns with your financial goals and risk tolerance.

Remember, the hobby thrives on passion and knowledge. Enjoy the thrill of the hunt, conduct thorough research, and make informed decisions to navigate the ever-evolving world of baseball card investing.

Disclaimer: This is a hobby blog and should not be relied on for investment advice.