Your cart is currently empty!

Baseball cards have been a cherished hobby for generations, but in recent years, they’ve also emerged as a potentially lucrative investment. The world of card collecting has evolved beyond nostalgia, with savvy investors recognizing the potential for significant returns. If you’re interested in building a portfolio of baseball cards, it’s crucial to understand which types of cards make the best baseball card investments and how to get started. In this article, we’ll explore the key investment types and provide tips for starting your card collection journey.

Types of Baseball Cards for Investment

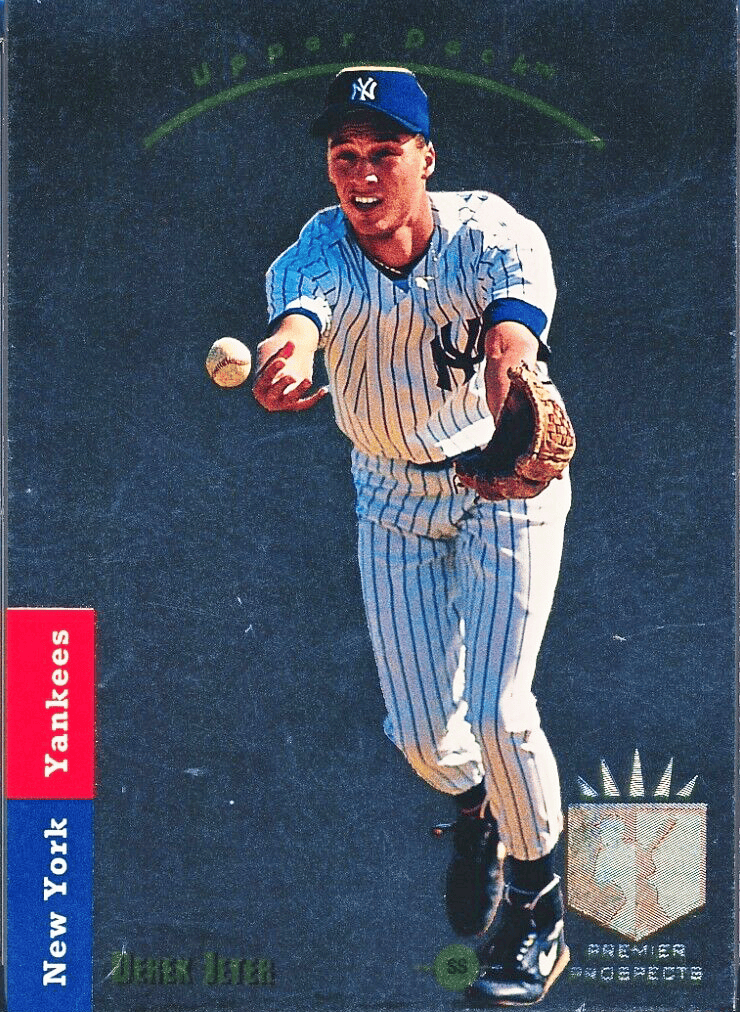

Rookie Cards

Rookie cards are often the most sought-after cards in the hobby. These cards feature a player’s first appearance in a major card set and can gain substantial value as the player’s career progresses. Look for rookies of promising young talents, as their performance and popularity can skyrocket.

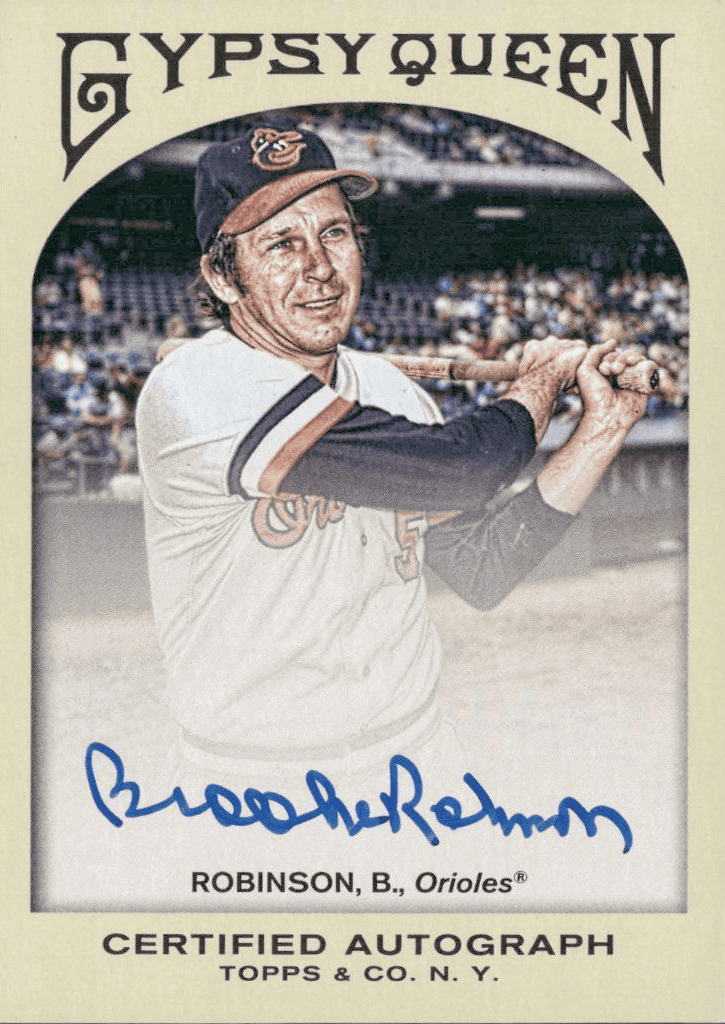

Autographed Cards

Autographed cards, especially those with certified signatures, are highly desirable among collectors and investors. The rarity of the autograph and the player’s status in the sport can significantly impact the card’s value.

Game-Used Memorabilia Cards

Cards featuring pieces of game-used memorabilia, such as jerseys or bats, offer a tangible connection to the sport. These relics can be highly coveted by collectors and investors, especially if they come from notable players or historic moments. Some cards, like Topps Chrome Authentics, even let you track the piece of jersey or equipment right down to the game where it was used.

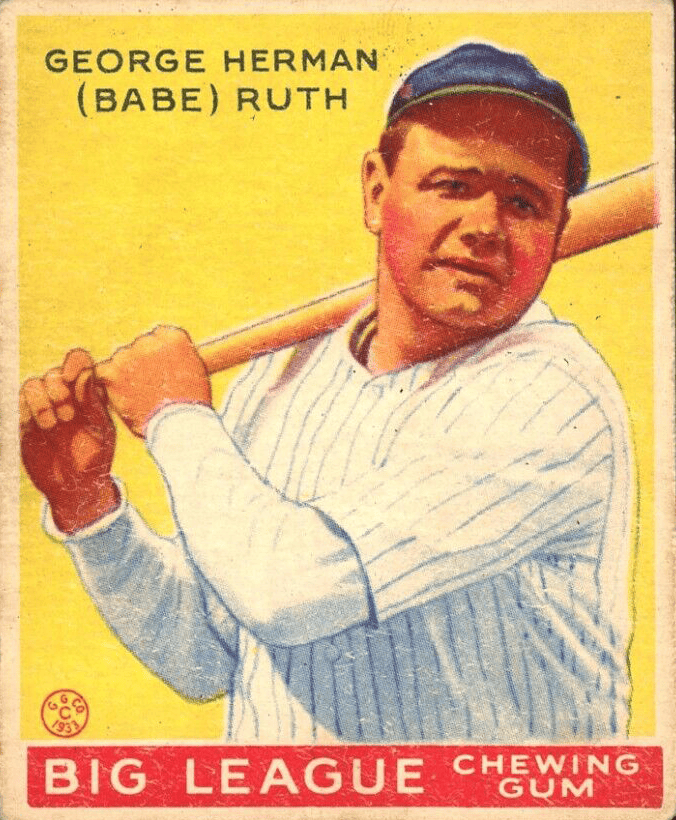

Vintage Cards

Vintage cards, typically defined as those produced before the 1980s, have a timeless appeal. They often hold historical significance and can appreciate in value over time, making them attractive long-term investments. They also tend to be rarer than modern cards, because they existed before the collecting boom, when many collectors became aware of the value and condition of their collections.

Graded Cards

Professional grading services, such as PSA (Professional Sports Authenticator) or BGS (Beckett Grading Services), assess the condition and authenticity of cards. Graded cards provide a clear indication of a card’s quality and can command higher prices than ungraded counterparts.

Getting Started with Your Card Collection

Choose your niche and decide on the types of cards you want to focus on. Consider your interests, risk tolerance, and investment goals. Some collectors specialize in rookies, while others prefer vintage cards or autographed memorabilia. You can even choose cards from only your favorite team (hint, hint).

Next, determine how much you’re willing to invest in your card collection. Setting a budget helps you stay disciplined and avoid overspending. And remember, it’s your portfolio. You choose everything in it! Collectors come in all shapes and sizes. Some love to chase famous cards, while others follow a specific era or team (hint, hint). You don’t need to be a millionaire to get started, either. You’re not wrong for choosing the investing strategy that works for you.

Finally, consider card grading for your most valuable purchases, and those that are high risk, such as older cards that are prone to trimming or retouching. Grading from a company like PSA, Beckett or SCG adds authenticity and transparency to the condition of the card, which can be crucial for investors.

Running Your Collection Like an Investment

Diversifying your portfolio is a key for any investor. When you avoid putting all your investments into a single card or player, you minimize your risk if one of those players is a bust. You can diversify by acquiring cards from different eras or featuring various players to help spread risk.

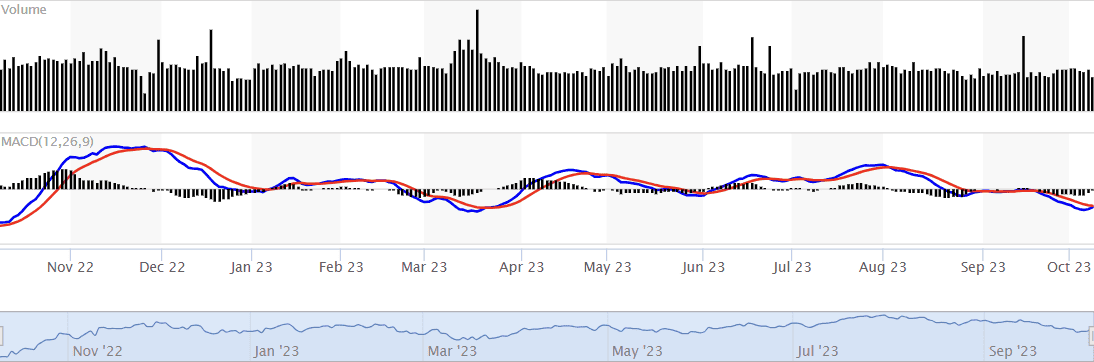

Also, baseball card investments are often best approached with a long-term perspective. Be patient and willing to hold onto your cards for several years to maximize their potential value appreciation. Special events like jersey retirements and Hall of Fame inductions can spike interest in a player and may be a good time to sell.

Finally, stay informed: Continuously monitor the baseball card market, player performances, and industry trends. Be prepared to adapt your collection strategy based on evolving market dynamics. A good example of a time-sensitive pivot was the drop in card values when some 1990s and 2000s players were implicated in the steroid investigation.

In conclusion, building a portfolio of baseball cards can be a rewarding and potentially profitable endeavor. To make the best investments, focus on rookie cards, autographed cards, game-used memorabilia cards, low-print runs, vintage cards, and graded cards. Additionally, conducting thorough research, setting a budget, and diversifying your collection can help you navigate the world of baseball card investments successfully. Remember that the key to success in this hobby lies in a combination of passion, knowledge, and patience. Happy collecting and investing!

Tags:

Share: